For the first time since the launch of Global Industry Classification Standard (GICS) in 1999, a new headline sector has been added to the S&P 500 Index. Equity REITs was added as the 11th sector by MSCI and S&P Dow Jones as part of their annual index rebalancing on September 16, 2016. This designation as a standalone class shows the growth and capital representation of REITs as they have been included in the S&P indexes under the financial sector since 2001.

For the first time since the launch of Global Industry Classification Standard (GICS) in 1999, a new headline sector has been added to the S&P 500 Index. Equity REITs was added as the 11th sector by MSCI and S&P Dow Jones as part of their annual index rebalancing on September 16, 2016. This designation as a standalone class shows the growth and capital representation of REITs as they have been included in the S&P indexes under the financial sector since 2001.

REITs have become increasingly popular with investors as their management teams have become more professional and the companies have become larger. There are two main types of REITs, equity REITs and mortgage REITs. The newly added sector will only include equity REITs that own physical property such as apartments, office buildings, industrial buildings, malls, hotels, cellular towers, data storage facilities, self-storage facilities, movie theaters, timber and even prisons. Mortgage REITs will remain as a subset of the financial sector.

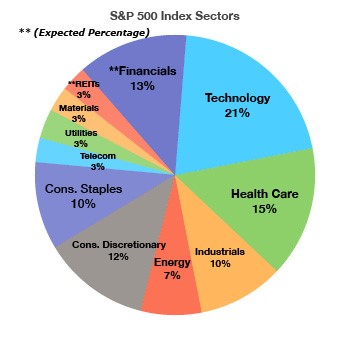

REITs currently constitute about 3% of the S&P 500, so it is estimated that the newly created 11th sector will make up about 3% of the total index. Sector weightings comprising the S&P 500 vary as the economy shifts and industries evolve. We can expect increased attention and visibility from investors as many firms adjust their asset allocations to match the revised S&P weightings. We may also see an increase in prices if the normal rules of supply and demand apply as fund managers rebalance their industry allocations.

While REITs have not played into our standard investment models it will be interesting to see how this new headline sector fares in the upcoming months and years. It is possible that, with a larger and more diverse investor base, the reclassification lends a touch of moderation to the severity of real estate market cycles.

Max W. Smith, CFP®, CIMA® | Kent G. Forsey, CFP®

Sources: S&P, Bloomberg, Global Industry Classification Standard (GICS), MarketWatch, REIT Magazine