Taking full advantage of employer 401(k) or other retirement benefits will continue to be vital to successful retirement planning as reduced social security benefits becomes more likely the longer Congress waits to take action.

Taking full advantage of employer 401(k) or other retirement benefits will continue to be vital to successful retirement planning as reduced social security benefits becomes more likely the longer Congress waits to take action.

A U.S. Government report compiled and released by the Government Accountability Office (GAO) found that 48 percent of individuals 55 and older had no retirement savings whatsoever. Statistics like this are where the concept of Social Security originated from.

The establishment of Social Security occurred on August 14, 1935, when President Roosevelt signed the Social Security Act into law. Since then, Social Security has provided millions of Americans with benefit payments. Over the decades, Americans have become increasingly more dependent on Social Security payments; however, for some Americans it may not be enough to rely on Social Security alone.

As of April 2019, over 63 million Americans received Social Security benefit payments, with over 40 million age 65 or older. The Social Security Administration estimates that Americans received over $989 billion in Social Security benefit payments in 2018.

Unfortunately, Social Security is a major source of income for many of the elderly, where nine out of ten retirees 65 years of age and older receive benefit payments representing an average of 41% of their income.

In 1940, the life expectancy of a 65-year old was 14 years, today it’s about 20 years.

By 2036 there will be almost twice as many older Americans eligible for benefits as today, from 41.9 million to 78.1 million.

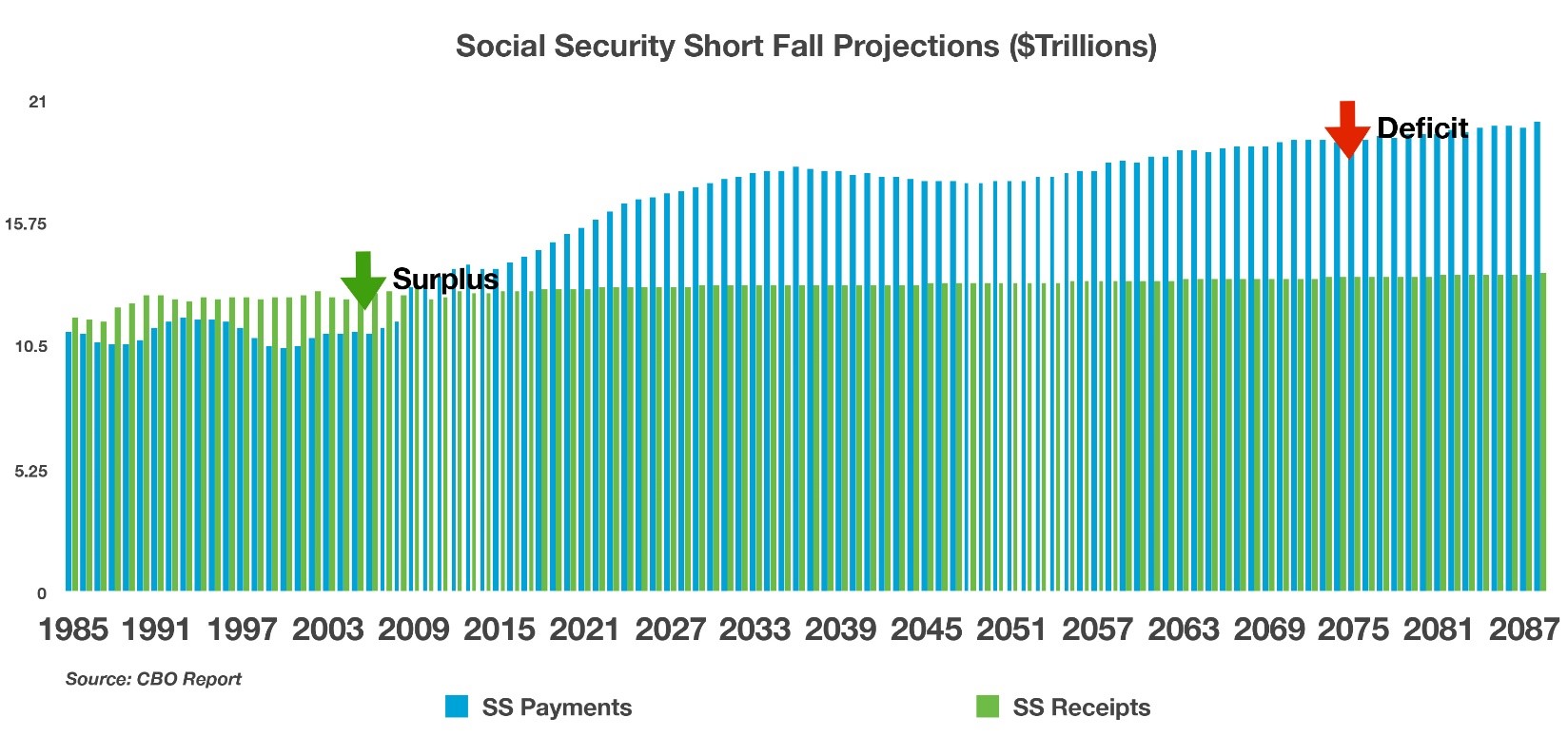

Social Security costs will exceed its income in 2020 for the first time since 1982, forcing the program to dip into it’s trust fund, which is currently just under $3 trillion. Social Security is funded by two trust funds, one for retiree benefits and another for disability benefits. Disability applications have actually been declining since 2010, with a decreasing number of workers receiving disability benefits since 2014.

The latest annual report issued by the trustees of Social Security and Medicare revealed that by 2034, the program’s trust fund will be depleted. Depletion means that Social Security recipients will no longer be receiving full scheduled benefits. Recipients would receive about three-quarters of their scheduled benefits after 2034. Congress can eventually act to fortify the program’s finances, but it may be years before it actually takes effect and funds.

Social Security’s largest costs are attributable to Medicare, which represents over 76% of Social Security benefits. The report also mentioned that Medicare’s hospital insurance fund would be depleted in 2026. The trustees noted that the aging population of the country has placed additional pressure on both the Social Security and Medicare programs. A decade ago, roughly 12% of Americans were age 65 or older, today 16% of Americans have already surpassed 65, the eligibility age for Medicare.

The Social Security Administration considers various factors in projecting its estimates, including fertility, immigration, wages, health, and economic growth. A recent drop in U.S. birthrates along with stagnant wages has placed additional burden on the viability of future benefit payments.

Sincerely,

Kent G. Forsey, CFP®

President

Sources: https://www.ssa.gov/oact/TR/2019/index.html; OneBlueWindow