Hillspring Financial

Establishing Clear Expectations for Investor Experience

Outdated Methods Still Used by Most

Typically financial advisors will begin with a multiple-part “Risk Questionnaire”. Then with the results of this questionnaire, they will place their clients into one of four to six canned risk models. The most common model is a “Balanced” or “Moderate” model for investors with average risk tolerance. We must ask ourselves: How has this process worked out?

A quick review of the Morningstar mutual funds “Moderate” category shows returns for the 12 months ending October 1, 2013 varying all the way from #31.16% to -1.27%.

Isn’t it interesting that fund managers who outwardly fit in the same “moderate” risk category could have such a wide variance of returns during the same time period. This broad approach to managing risk and return is obviously no longer adequate. Our economic world has evolved – dramatically – during the past decade or so. It now takes a much more sophisticated approach to successfully meet one’s investment expectations.

Evolutionary Research Capability Takes Managing Invested Assets to Entirely New Levels

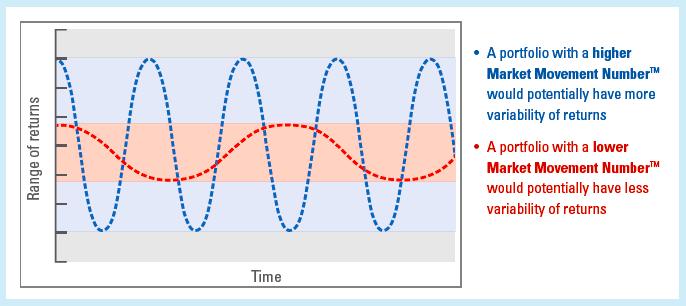

Rather than an asset mix dictating how much volatility an investor incurs without any bounds, our approach begins with determining an investor’s Market Movement NumberTM and an agreed upon acceptable range of volatility going forward.

By tailoring the portfolio to each investors unique Market Movement NumberTM, we have better control over the investor experience and are able to set clear expectations.

Hillspring Financial is allied with a highly sophisticated research team; “Market Movement Solutions”. Together with their innovative research capabilities and our investment management experience, we have developed a special proprietary process. With this refined process we are able to design each client’s portfolio with precise volatility measurements. This capability allows us to provide the much-needed confidence that expectations may be more closely met in a given economic environment.

This is an exciting breakthrough we are anxious to show you. Give us a call and we’ll review the details on how it could work for you.

To Learn more – click HERE for a more detailed and expanded PDF Version of this information you can view or print.

An additional slide presentation PDF can be viewed or printed HERE..

#Morningstar.com October 2, 2013

Putnam Capital Spectrum Y Category: Moderate 1 Year return: 31.16%

Adaptive Allocation A Category: Moderate 1 Year return: -1.27